Safeguard Your Business with Smart Revenue Protection

Running a business means juggling a lot of risks, and one of the biggest is unpaid invoices. If clients don’t pay on time—or at all—your cash flow takes a hit. That’s where a solid strategy to protect your accounts receivable comes in. It’s not just about chasing payments; it’s about building a system that prevents losses before they happen.

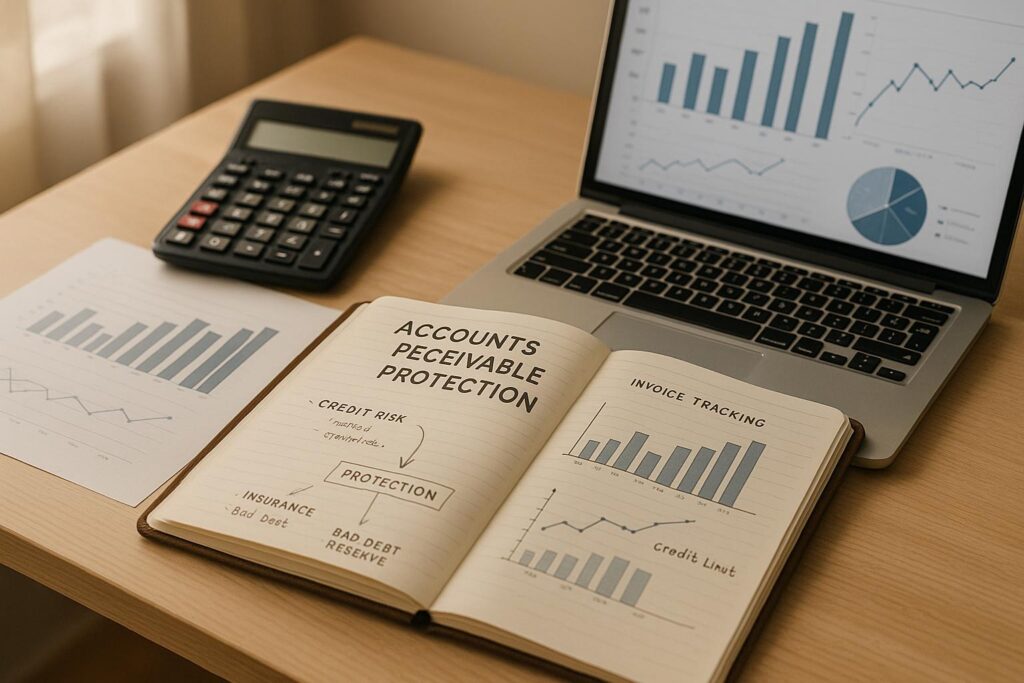

Why Protecting Receivables Matters

Every dollar tied up in unpaid invoices is a dollar you can’t reinvest in growth. Small businesses, in particular, feel the sting of bad debts, with some losing thousands annually to non-payment. Crafting a tailored plan to shield your revenue doesn’t have to be complicated, though. By assessing your risk areas—whether it’s customer insolvency or industry ups and downs—you can take proactive steps. Think credit vetting for new clients, clearer payment terms, or even insurance for high-stake accounts. These moves create a buffer, so you’re not left scrambling if a client defaults.

Start Building Your Safety Net

Don’t wait for a financial hiccup to act. A tool designed for safeguarding receivables can map out the right mix of strategies for your business, keeping your hard-earned money where it belongs—with you.

FAQs

Why do I need an accounts receivable protection plan?

If your business relies on clients paying invoices, you’re exposed to risks like non-payment or delays that can hurt cash flow. A protection plan acts like a safety net, helping you avoid losses from bad debts. Our tool looks at your specific numbers and concerns to suggest practical steps, whether it’s tightening credit checks or getting insurance. It’s all about keeping your revenue secure without overcomplicating things.

How much does a protection strategy cost?

Costs depend on the protection level you choose and your receivables amount. For instance, a Basic plan might just involve internal processes like credit checks, which are often free or low-cost. A Comprehensive plan could include trade credit insurance, typically around 0.5% of your receivables. Our tool breaks down estimated costs so you can weigh your options and pick what fits your budget.

Can this tool help with late payments specifically?

Absolutely! Late payments are a common headache for businesses, and our planner can zero in on that. If you select ‘Late Payments’ as your primary concern, the tool prioritizes strategies like optimizing payment terms or setting up stricter follow-up processes. You’ll get a clear list of actions tailored to speed up collections and keep your cash flow steady.