Understanding Trade Credit Insurance Costs

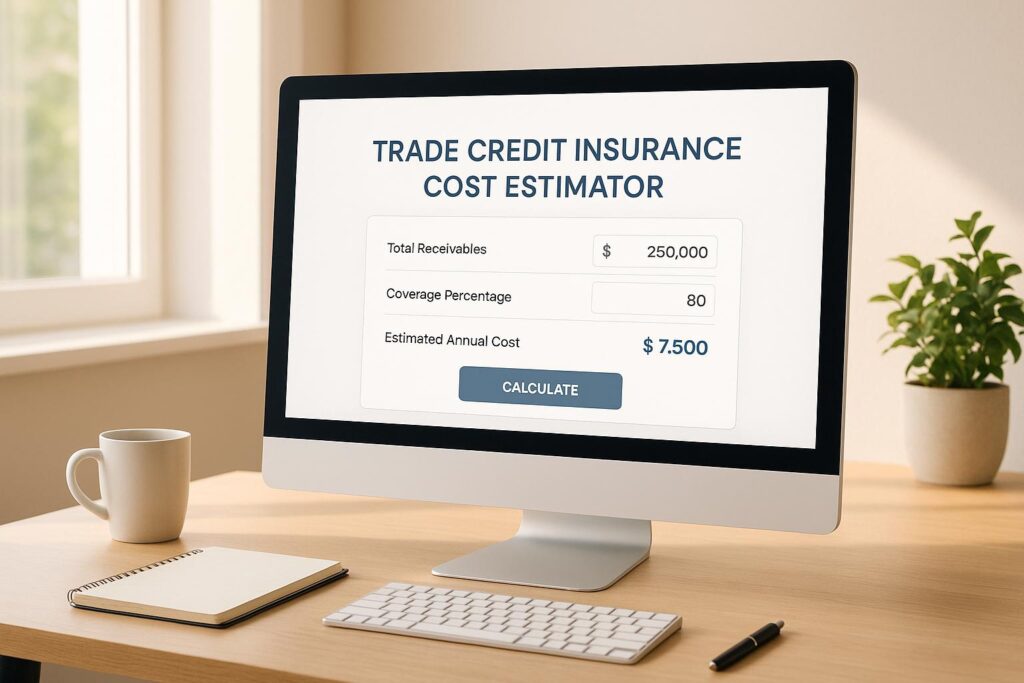

Running a business often means extending credit to clients, but what happens if they can’t pay? That’s where trade credit protection comes in, acting as a buffer against financial hiccups. Figuring out the cost of this safeguard, though, can be tricky with so many variables at play. Our estimator tool takes the guesswork out of the equation by letting you input key details like your trade volume and client locations to get a personalized snapshot of potential premiums.

Why Costs Vary

Every business is unique, and so are the risks tied to it. If you’re in a high-stakes field like construction, insurers might bump up rates due to the industry’s unpredictability. The same goes for where your clients are based—dealing with markets in less stable regions can nudge costs higher. Beyond that, the amount of credit you choose to cover also shapes the final figure. With our calculator, you’ll see a clear breakdown of these factors, helping you weigh your options. It’s a practical first step to securing your cash flow without overpaying for coverage you might not need. Keep in mind, though, that chatting with an insurer will give you the full picture for your specific situation.

FAQs

What is trade credit insurance, and why do I need it?

Trade credit insurance protects your business from losses if a customer fails to pay their invoices due to insolvency or other issues. It’s especially handy if you rely on a few big clients or operate in volatile markets. Think of it as a safety net—it helps you manage cash flow risks and keeps your business stable even if a payment falls through.

How accurate is this cost estimator for trade credit insurance?

Our tool provides a solid starting point based on standard industry and geographic risk factors, using a base rate of 0.5% with adjustments. However, actual premiums can differ depending on the insurer’s policies, your credit history, or specific terms. Use this as a guide, and reach out to providers for a tailored quote.

Does the industry or region really affect insurance costs that much?

Yes, they can make a noticeable difference. Industries like construction carry higher risks due to project delays or economic swings, so premiums often rise by 0.2%. Similarly, regions like Asia might add 0.3% to the rate because of varying economic stability or legal frameworks. Our tool breaks down these factors so you can see exactly what’s driving the cost.