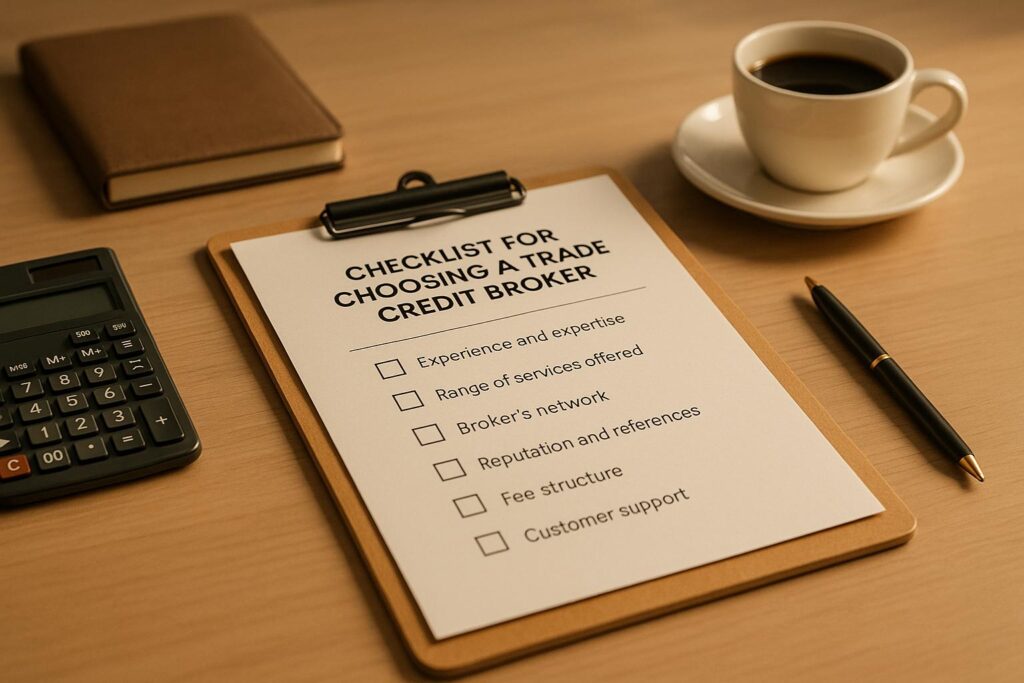

Selecting the right trade credit broker is critical for protecting your business from risks like non-payment or bankruptcy. Here’s a quick guide to help you make an informed decision:

- Verify Licensing and Compliance: Ensure the broker is licensed and has a clean regulatory history.

- Assess Expertise: Look for brokers with deep knowledge of trade credit insurance and experience in your industry.

- Check Client Feedback: Read reviews and testimonials to understand their service quality.

- Review Services and Coverage: Confirm they offer access to multiple carriers, tailored policies, and strong claims management.

- Examine Contract Terms: Understand cancellation policies, fees, and flexibility for adjustments.

What Is The Role Of A Trade Credit Broker? – InsuranceGuide360.com

Step 1: Check Regulatory Compliance and Licensing

Before diving into a broker’s experience or fees, make sure they’re legally authorized to operate. This is a critical step to protect yourself from potential fraud.

Verify Licensing and Registrations

Every trade credit broker is required to hold a valid state license. To confirm this, visit your state’s insurance department website. Most states offer online databases where you can search for licensed insurance professionals by their name or company.

Additionally, the broker should be registered with the National Association of Insurance Commissioners (NAIC). The NAIC plays a key role in coordinating oversight among state insurance regulators, making it a trusted resource for verifying a broker’s credentials. Their database allows you to check the broker’s registration status and view any public records tied to their professional standing.

Professional designations can also signal expertise, but they should be accredited by recognized bodies like the ANSI National Accreditation Board (ANAB) or the National Commission for Certifying Agencies (NCCA). In fact, some state regulators require these accreditations for certain designations.

Once you’ve confirmed licensing, it’s time to dig into the broker’s compliance history.

Review Regulatory Compliance History

A broker’s compliance record offers valuable insight into their professionalism and trustworthiness. After verifying their licensure, check for any history of sanctions, penalties, or legal issues. Many state insurance department websites maintain records of disciplinary actions, which can help you identify potential red flags.

You may also want to look for evidence that the broker stays current with compliance education or holds relevant certifications. This shows a commitment to maintaining high standards.

Transparency is another key indicator of a broker’s reliability. A trustworthy broker will readily share their license numbers and be open about their regulatory standing. If they hesitate or seem evasive when asked about their credentials or compliance history, consider it a warning sign and explore other options.

Step 2: Assess Broker Expertise and Specialization

After confirming a broker’s regulatory compliance, the next step is to evaluate their expertise. Not all brokers bring the same level of experience to the table, and choosing one with the right knowledge can make a huge difference – not just in securing adequate coverage but in ensuring your policy truly protects your business.

Evaluate Experience in Trade Credit Insurance

Trade credit insurance requires a specific skill set. Brokers with extensive market knowledge and strong relationships with multiple carriers are better equipped to guide you through the process effectively.

Experienced trade credit brokers can spot high-risk customers and recommend appropriate credit limits. Their claims management record is especially important, as this often reveals how well they handle industry-specific challenges. Don’t hesitate to ask for details about their claims history – how they’ve stepped in during critical moments can speak volumes. For instance, in late October 2024, Lockton‘s programs swiftly resolved claims for clients facing significant financial difficulties.

Look for Industry-Specific Knowledge

Each industry comes with its own set of risks, payment norms, and customer behaviors. A broker who understands these nuances can analyze your business needs, risk profile, and trade practices to create a policy tailored to your industry.

For example, construction suppliers may deal with project-based payments and contractor insolvencies, while exporters might face challenges like political instability or currency fluctuations. During your search, ask brokers about their experience working with businesses like yours. Request case studies or examples that demonstrate their understanding of your industry’s unique risks. This expertise is key to crafting policies that align with your business model.

Assess Customization Capabilities

Avoid brokers who push generic, one-size-fits-all policies. The right broker will offer flexible solutions tailored to your business needs and risk tolerance. They should be able to design policies for both domestic and international markets, covering services like claims management and risk assessments.

Seek brokers who can provide different policy structures to suit your specific needs, whether that’s coverage for your entire accounts receivable portfolio (whole turnover), selected key buyers, or even an individual buyer. Geographic flexibility is equally important. Your broker should handle domestic, export, or combined sales, with options for regional or global coverage, including multinational programs that integrate local and international credit insurance.

Customization should also extend to the types of risks covered. A skilled broker can help you navigate commercial risks like insolvency or late payments, as well as political risks such as government moratoriums, conflict, or defaults by public buyers. Additionally, they should offer solutions aimed at specific goals, like entering new markets, building relationships with key customers, boosting sales, or improving access to financing.

When assessing brokers, prioritize those who emphasize tailored solutions and proactive risk management. For instance, Accounts Receivable Insurance uses its deep expertise to craft personalized trade credit policies and manage claims efficiently, ensuring that businesses receive the coverage they need for both local and international operations.

Step 3: Research Reputation and Client Feedback

After assessing a broker’s expertise and specialization, the next step is to dive into client experiences. While credentials and qualifications matter, real-world feedback from clients provides a clearer picture of a broker’s service quality, reliability, and transparency. These insights can help you steer clear of costly missteps.

Read Independent Reviews and Testimonials

Start by exploring independent review platforms like Trustpilot, Google Reviews, and industry-specific forums. These sources can reveal trends in customer satisfaction that might not be obvious in promotional materials.

Don’t just glance at star ratings – dig deeper into the comments. For instance, Trustburn reports an average rating of 4.2 for trade credit brokers based on nine reviews. The details in these reviews can highlight what clients appreciated or where they faced challenges. Negative feedback, in particular, can flag potential concerns such as hidden fees or subpar service. Look for recurring complaints and note whether the broker actively addresses these issues.

Professional forums and networks are also valuable. They often feature discussions from peers sharing their experiences with specific brokers, offering practical advice and insights that go beyond standard review sites. These conversations can help you gauge how a broker communicates and manages relationships.

Check for Transparency and Communication

Client feedback often reveals a broker’s approach to communication and transparency. Look for comments that discuss clarity around fees, data sharing, and responsiveness.

Fee transparency is especially important. Reviews should confirm whether brokers clearly outline all costs upfront, including any additional charges or surcharges. Hidden fees can create unnecessary frustration, so clarity here is non-negotiable.

Also, evaluate how brokers handle different communication preferences. Do they adapt to client needs, such as providing updates via email or phone? Are they quick to respond to inquiries? Feedback on these points will give you a sense of how well the broker aligns with your expectations.

Review Client Support Track Record

The quality of ongoing support can make or break your long-term relationship with a broker. Look for testimonials that highlight how brokers perform during critical moments, such as claims processing, policy updates, or unexpected challenges.

Pay close attention to feedback on claims management. How responsive and efficient is the broker when handling claims? Do they provide timely support during policy adjustments? Gaps in these areas can lead to unnecessary complications during financial difficulties.

As your business evolves, your insurance needs may change. Reviews should indicate whether the broker proactively suggests policy improvements or only reacts when prompted. This can signal their commitment to your long-term success.

Lastly, consider testimonials that mention long-term client relationships. Brokers who maintain lasting partnerships often deliver consistent, dependable service. On the other hand, a pattern of short-term engagements might suggest underlying issues with client satisfaction.

sbb-itb-2d170b0

Step 4: Review Service Offerings and Coverage Options

Once you’ve assessed a broker’s reputation and client feedback, it’s time to dive into their service offerings and coverage options. This step is all about ensuring you get the protection you need by examining their carrier partnerships, ability to tailor policies, and the level of ongoing support they provide.

Verify Access to Multiple Carriers

A broker’s network of insurance carriers plays a key role in the range and quality of options they can offer. Brokers with strong ties to multiple carriers often deliver better pricing, more favorable terms, and even access to specialized policies that smaller networks might not provide.

For instance, one broker showcases their robust relationships with insurers, offering a wide variety of products and underwriting capabilities. This extensive network enables them to align coverage with specific business needs. Additionally, brokers with close connections to underwriters often have greater leverage when negotiating terms. As Trade Credit Solutions Ltd emphasizes:

Our speciality is tailor-making policies to the very individual requirements of each one of our clients.

To assess a broker’s carrier access, ask for details about their network. How many carriers do they regularly collaborate with? Do their partners include both large international insurers and niche providers? What is the geographical scope of their network? These questions will help you determine whether the broker can truly shop the market on your behalf. A broad network is the foundation for offering flexible and tailored coverage options.

Check Policy Customization Options

Off-the-shelf trade credit insurance policies rarely address the unique risks of every business. A good broker should be able to adapt coverage to your specific needs, whether that involves protecting against domestic payment defaults, covering international client bankruptcies, or mitigating political risks in emerging markets.

For example, they should offer various policy types, such as whole turnover coverage, major debtor protection, or start-up-focused policies, all tailored to your risk profile. This allows you to direct coverage where it’s needed most, avoiding unnecessary expenses.

It’s also important to confirm that your broker can make adjustments to your policy as your business grows or changes. Whether it’s raising coverage limits, adding new markets, or removing outdated ones, this flexibility ensures your policy evolves alongside your business. Such adaptability is a key part of a broker’s overall value.

Review Claims Management Services

How a broker handles claims can set them apart from the competition. When a customer defaults or an unexpected event triggers a claim, you’ll want a broker who can guide you through the process smoothly and advocate on your behalf with the insurer.

Look for brokers who take a proactive approach, offering pre-claim interventions to recover overdue payments before they escalate. This not only helps recover funds that might otherwise be lost but also maintains important customer relationships.

When a claim is filed, the broker should handle the paperwork, maintain clear communication with insurers, and keep you updated throughout the process. Ask about their claims success rates and average resolution times. How often do they secure full settlements? What’s the typical timeline from claim submission to payout?

Additionally, consider whether they provide post-claim support. Do they help monitor accounts to prevent future issues? Can they adjust credit limits based on previous claims experience? These added services show a commitment to your long-term success, going beyond just placing a policy.

Step 5: Examine Contract Terms

After exploring service offerings and coverage options, it’s time to dive into the details of the contract terms to ensure they align with your needs. Pay close attention to how flexible the agreement is, as this can make a big difference when tailoring policies to fit your business, industry requirements, and customer base.

Key elements to review include cancellation policies, renewal terms, and commitment periods. These factors should align with your business’s changing needs. It’s also important to look at the fee structure, payment plans, and any potential penalties for ending the contract early. On top of that, check how the contract handles changes, such as adjusting coverage or modifying policies, as well as how disputes are resolved. These details can help ensure your business remains protected as it evolves.

Conclusion: Making an Informed Decision

Choosing the right trade credit broker requires a thoughtful and structured approach. This five-step checklist offers a clear path to making a decision that safeguards your accounts receivable.

Here’s a quick recap of the key steps: Start by ensuring the broker complies with all regulatory standards to avoid legal issues and maintain professionalism. Look for specialized knowledge in trade credit insurance, especially from brokers who understand your industry’s specific needs and can provide tailored advice. Review client feedback and assess their communication practices to gauge reliability and future performance. Examine the range of services they offer – such as access to multiple carriers, policy customization, and claims management – to ensure they meet all your requirements. Finally, focus on overall value rather than just cost by considering their fee structure alongside their ability to deliver effective results.

While cost matters, it’s crucial to prioritize value. Opting for the cheapest broker can lead to coverage gaps when you need protection the most.

FAQs

Why should I check a trade credit broker’s licensing and compliance before hiring them?

Ensuring that a trade credit broker holds the proper licensing and complies with regulations is crucial for safeguarding your business. Licensed brokers are bound by legal standards and ethical practices, which can help minimize the risks of fraud, financial penalties, or other liabilities.

Taking the time to verify a broker’s credentials gives you peace of mind. It confirms that they are qualified to meet your needs and operate within the necessary regulatory framework to protect your business interests.

How does a trade credit broker’s expertise help improve my insurance coverage?

When it comes to protecting your business, a trade credit broker brings a level of expertise that can make all the difference. They work to shape your insurance coverage around the specific risks and demands of your industry, ensuring it aligns perfectly with your business needs.

With their deep understanding of trade environments, brokers can pinpoint potential weak spots, suggest tailored policy features, and help fill any gaps in your coverage. Whether it’s addressing risks like non-payment or bankruptcy, their goal is to provide a safety net that not only shields your business but also promotes financial security and growth.

What should I look for in a broker’s reputation and client feedback to ensure reliable service?

When assessing a broker’s reputation and client feedback, it’s essential to look at their track record and overall trustworthiness. Start by diving into testimonials, ratings, and reviews from both current and former clients. These can give you a clear picture of the broker’s reliability and the quality of their services. Consistently positive feedback often signals a high level of professionalism and customer care.

Beyond client reviews, consider how the broker is viewed within their industry. Ask for business references or perform a background check using trusted sources to confirm their standing. Partnering with a broker who has a strong, established reputation means you’re more likely to receive reliable trade credit services that align with your business goals.