Dynamic risk adjustment models are reshaping how businesses and insurers manage risks in a fast-changing world. Unlike older methods that rely on historical data, these models use real-time updates to predict and respond to risks as they emerge. Here’s why they matter:

- Real-Time Data: Continuously monitors and adjusts to evolving risks.

- Improved Accuracy: Reduces reliance on outdated data for better predictions.

- Faster Responses: Helps businesses act quickly to minimize losses.

- AI and Machine Learning: Key drivers enabling smarter risk assessments.

- Climate and Geopolitical Risks: Addresses challenges like natural disasters and political instability.

For U.S. businesses, adopting these models isn’t optional anymore. They enhance trade credit insurance, improve cash flow, and reduce financial losses. Companies using these strategies report up to 25% higher shareholder returns during uncertain times. The future of risk management is here – adapting to it now ensures resilience in a volatile global economy.

Dynamic Risk Assessment

How Dynamic Risk Adjustment Models Developed

The shift from static to dynamic risk adjustment models didn’t happen overnight. It was a gradual process, shaped by market challenges, technological advancements, and global shifts that highlighted the flaws in static models. Understanding this evolution sheds light on why dynamic models are now critical for managing risk in today’s complex world.

From Static to Dynamic Risk Management

To appreciate the impact of dynamic models, it helps to first look at how they emerged. Traditional risk management, often referred to as static risk management, operated on fixed frameworks and periodic reviews. These models were effective in stable environments where risks followed predictable patterns.

Static models focused on risks within linear systems. The process was straightforward: conduct risk assessments quarterly or annually, document the findings, and implement controls based on past data. While this worked in simpler times, it fell short as business environments grew more complex.

The limitations of static models became glaringly obvious in dynamic, interconnected systems where risks are unpredictable and non-linear. Static approaches assumed that risks followed a cause-and-effect pattern, which doesn’t hold in today’s volatile markets. Over-reliance on historical data also led to "Black Swan Blindness" – the inability to foresee rare, high-impact events. Hedge fund manager Martin Taylor summed it up well:

"We have never had and would never use any form of quantitative risk control because all quantitative risk control models use historical volatility. It is like driving by looking in the rearview mirror."

Another issue was that static models focused too narrowly on risks within a single organization, ignoring broader systemic risks. Their rigid frameworks also left businesses ill-equipped to handle sudden disruptions.

Dynamic Risk Management (DRM) emerged to address these shortcomings. Unlike static models, DRM emphasizes agility and adaptability, using real-time data to continuously assess and respond to evolving risks.

Key Drivers of Change

Several forces pushed the transformation from static to dynamic risk management, each addressing the gaps in older methods.

Technological Advancements

A major driver has been the rapid rise of artificial intelligence (AI) and machine learning (ML). The market for AI in banking alone was valued at $160 billion in 2024 and is projected to reach $300 billion by 2030. This surge underscores how transformative these technologies are for risk management.

AI and ML have revolutionized credit decisions and risk evaluations. Machine learning algorithms can analyze massive datasets to uncover patterns and correlations that traditional models would miss. Unlike static models, ML systems adapt as they process new data, enabling ongoing risk assessment throughout a business relationship.

For example, Ping An uses image analytics to evaluate client expressions in real time during loan applications. Such real-time risk evaluation was unimaginable with older static models. Similarly, the insurance sector now leverages advanced ML and deep learning to predict risks, customize policies, and automate claims processing. As one expert put it:

"As technology evolves, it’s evident that AI and ML are not just fleeting trends but are integral to the future of banking".

Economic and Geopolitical Challenges

Economic instability has created an environment where static models can’t keep up. Sluggish global growth, rising energy costs, inflation, and high interest rates have increased the likelihood of payment delays and defaults. These conditions demand real-time risk assessment, which static models simply can’t provide.

Geopolitical shifts have added another layer of complexity. Political instability, conflicts, and regulatory changes have reshaped the global landscape. Today, 112 out of 162 countries face higher political and social risks compared to pre-2020 levels. Ruben Nizard, Head of Sector and Political Risk Analysis at Coface, explained:

"Political and social risks remain at extremely high levels. This demonstrates that a new chapter begins in a world in profound mutation, where the fractures between leading economies continue to reshape trade flows and to weaken political stability and social cohesion".

These economic and political pressures, combined with technological progress, have made dynamic approaches indispensable.

Regulatory and Market Shifts

Evolving regulations have also driven the adoption of dynamic risk models. Increasing isolationism has complicated risk mitigation for insurers, while traditional actuarial pricing methods have struggled to keep up with climate-related disasters and geopolitical tensions.

The need for more adaptable pricing strategies has led to dynamic pricing in insurance. This approach moves away from static pricing models, relying instead on real-time data to optimize risk assessment and pricing.

Climate Risks

Climate-related challenges have further exposed the inadequacies of static models. In 2024, global natural disasters caused economic losses of $368 billion, well above average. These losses are not only growing but also becoming harder to predict. Static models simply can’t handle the evolving nature of climate risks.

The urgency of these issues is reflected in the fact that 68% of financial services firms now rank AI-driven risk management initiatives as a top strategic priority. Together, these factors have made dynamic risk models a necessity for businesses navigating today’s unpredictable landscape.

Global Trends Shaping Dynamic Risk Adjustment

The world of trade credit insurance is evolving rapidly, with dynamic risk adjustment becoming a critical factor in distinguishing success from failure. Several global trends are driving this transformation, fundamentally reshaping how risks are assessed and managed.

Advanced Analytics and AI Integration

Artificial intelligence (AI) and machine learning are now central to modern risk adjustment models. These technologies are not just buzzwords – they’re reshaping industries. For instance, the global AI in finance market is projected to hit $190.33 billion by 2030, growing at an impressive annual rate of 30.6% between 2024 and 2030. In 2023 alone, financial services allocated about $35 billion to AI projects, signaling strong confidence in its capabilities. A survey by NVIDIA revealed that 86% of financial institutions reported revenue growth from AI, while 82% noted reduced costs.

The results speak for themselves. For example, Allianz saw a 15% boost in revenue and cut operational costs by up to 50% through AI integration. Similarly, Upstart’s AI-driven model increased borrower approvals by 44.28% while lowering annual percentage rates (APR) by 36%.

In trade credit insurance, AI plays a vital role by continuously analyzing massive datasets to uncover patterns and risks that traditional models might overlook. This ability to process and interpret data in real-time is crucial for navigating the complexities of global trade and identifying emerging financial risks as they arise.

AI adoption is accelerating across the financial sector. By 2025, 85% of financial institutions are expected to have integrated AI into their operations – nearly doubling from 45% in 2022. This trend is particularly relevant for trade credit insurance, where the U.S. market was valued at $2.02 billion in 2023 and is forecasted to grow at an annual rate of 10.6% through 2030.

These technological advancements are also helping insurers address broader risks, such as those linked to climate change and geopolitics.

Climate and Geopolitical Risk Focus

Climate change and geopolitical instability are increasingly interconnected, creating a challenging landscape for risk management. Worsening climate conditions often aggravate geopolitical tensions, which in turn hinder coordinated responses to environmental challenges.

The financial toll of climate risks is undeniable. In 2022, extreme weather events added nearly 1% to food inflation in Europe, while up to one-third of the recent food inflation in the UK has been attributed to climate-related impacts. Meanwhile, geopolitical risks continue to compound these challenges. In 2024, voters in countries representing 54% of the global population and nearly 60% of global GDP will head to the polls, injecting uncertainty into global markets.

The maritime dimension adds another layer of complexity. Oceans, which support 94% of all life on Earth, are responsible for 90% of global trade via shipping routes. Any disruptions to these critical pathways – whether due to climate events or geopolitical tensions – can ripple through supply chains, directly affecting trade credit insurance underwriting and claims.

Businesses are responding by weaving geopolitical considerations into their strategies and bolstering the resilience of their supply chains. As Courtney Rickert McCaffrey, EY Global Geostrategy Insights Leader at Ernst & Young LLP, explained:

"Successfully weaving geopolitical dynamics into corporate strategy will increasingly be a competitive advantage."

Additionally, trade credit insurers are increasingly factoring environmental, social, and governance (ESG) criteria into their risk assessments. This broader perspective allows for a more holistic evaluation, capturing both immediate financial risks and long-term sustainability challenges.

Regulatory Harmonization and Global Standards

While technology and risk factors evolve, regulatory convergence is also reshaping the trade credit insurance landscape. Global trade credit insurance premiums are expected to grow by about 6%, reaching $14.1 billion in 2023 and $14.8 billion in 2024. In 2020, the worldwide insured exposure under trade credit insurance stood at a staggering 2.4 trillion euros, underlining the immense scale of global trade.

Harmonized regulations simplify compliance by allowing companies to prepare a single set of documentation for multiple markets, saving time and resources. This approach reduces the risk of regulatory inconsistencies for insurers operating across borders and makes it easier to enter new markets by expanding the potential customer base. Consistent regulatory frameworks also ensure that businesses enjoy the same level of protection, regardless of where their trading partners are based.

For U.S. trade credit insurers, unified regulations improve risk portfolio management by creating predictable frameworks across diverse markets. Global organizations like the ICH, IMDRF, and WHO are instrumental in aligning regulatory standards, fostering a stable environment for developing advanced risk management models.

sbb-itb-2d170b0

Dynamic Risk Adjustment in Practice

Dynamic risk adjustment models are transforming how insurers manage risk in today’s fast-moving markets. By moving beyond static, outdated approaches, modern insurers are adopting advanced tools and methodologies that adapt to market changes in real time.

Leading Methodologies and Tools

At the heart of these advancements are machine learning (ML) and predictive analytics. These technologies analyze vast amounts of data, learning and improving continuously throughout a policy’s lifecycle. Unlike traditional systems that rely on rigid rules, ML can uncover patterns in data that human analysts might overlook. This leads to more precise predictions of default probabilities and potential losses.

Another key innovation is real-time data integration. Modern systems pull in live data to identify trends and predict payment defaults. This allows insurers to take proactive steps, often engaging with customers before a situation escalates into a claim .

Some companies are even exploring image analytics to push the boundaries of risk assessment. These tools provide new ways to evaluate risks, showcasing how far the field has advanced.

Blockchain technology is also gaining traction, particularly in trade credit insurance. By creating secure, immutable transaction records, blockchain reduces fraud risks and streamlines claim verification processes. Insurers are pairing this technology with predictive analytics and automation to enhance transparency and efficiency.

Take ECI, for example. This leader in trade credit insurance uses artificial intelligence to assess buyer risk across various markets. By analyzing both structured and unstructured data, ECI’s real-time analytics systems detect patterns and predict payment risks, enabling swift adjustments to risk strategies.

Advantages Over Older Models

Dynamic risk adjustment models offer clear advantages over traditional methods, particularly in their ability to adapt and respond quickly to changing conditions. Here’s how they compare:

| Feature | Traditional Risk Management | Dynamic Risk Management |

|---|---|---|

| Frequency | Periodic, scheduled assessments | Continuous, real-time monitoring |

| Data Sources | Static, historical data | Live data from various sources |

| Adaptability | Inflexible, checklist approach | Flexible, with ongoing risk updates |

| Response Time | Slower, reactive responses | Immediate, proactive adjustments |

| Accuracy | Limited by outdated data | Enhanced with real-time insights |

| Resource Use | Broad and inefficient | Targeted and efficient |

One of the standout benefits of dynamic models is their accuracy and speed. Real-time alerts and immediate mitigation strategies allow insurers to address risks before they escalate. Traditional approaches, on the other hand, often rely on older data and periodic reviews, which can delay responses.

Proactive risk management is another game-changer. Dynamic systems don’t wait for scheduled reviews – they continuously monitor conditions and adjust priorities as risks emerge. This is especially important in trade credit insurance, where market conditions and buyer health can shift rapidly.

Additionally, improved collection strategies are a direct result of these advancements. AI-driven systems automate data processing, underwriting, and pricing while predictive analytics forecast potential delinquencies. This enables insurers to engage with policyholders early, reducing the likelihood of payment issues.

Dynamic models also enhance fraud detection and compliance. By identifying suspicious patterns in real time, these systems help prevent financial losses and reduce legal risks.

Finally, operational efficiency sees a significant boost. Dynamic models enable insurers to focus resources on high-risk situations while streamlining processes for lower-risk accounts. Unlike traditional methods, which often apply a one-size-fits-all approach, this targeted strategy ensures better use of time and capital.

For companies like Accounts Receivable Insurance, these capabilities translate into more precise risk evaluations, faster claims processing, and policies that align with current market conditions. By continuously monitoring and adjusting risk parameters, insurers can offer coverage that evolves with the business landscape, protecting policyholders while maintaining profitability.

Impact on U.S. Businesses and Insurance Providers

Dynamic risk adjustment models are transforming how U.S. businesses and insurance providers handle trade credit protection. These models are driving better efficiency, sharper risk assessments, and smoother claims processes.

Better Underwriting and Claims Management

Dynamic models are changing the game for U.S. trade credit underwriting. Over 65% of professionals in claims and underwriting are planning significant investments in AI-driven tools to enhance these processes. Major insurers have already seen impressive results, cutting down turnaround times and speeding up policy issuance. Real-time fraud detection and dynamic pricing allow underwriters to adapt quickly to market shifts, which is critical given that fraudulent claims represent about 10% of losses in the U.S. property-casualty sector. These advancements enable more precise, tailored solutions for a variety of risk profiles.

The Value of Customized Insurance Solutions

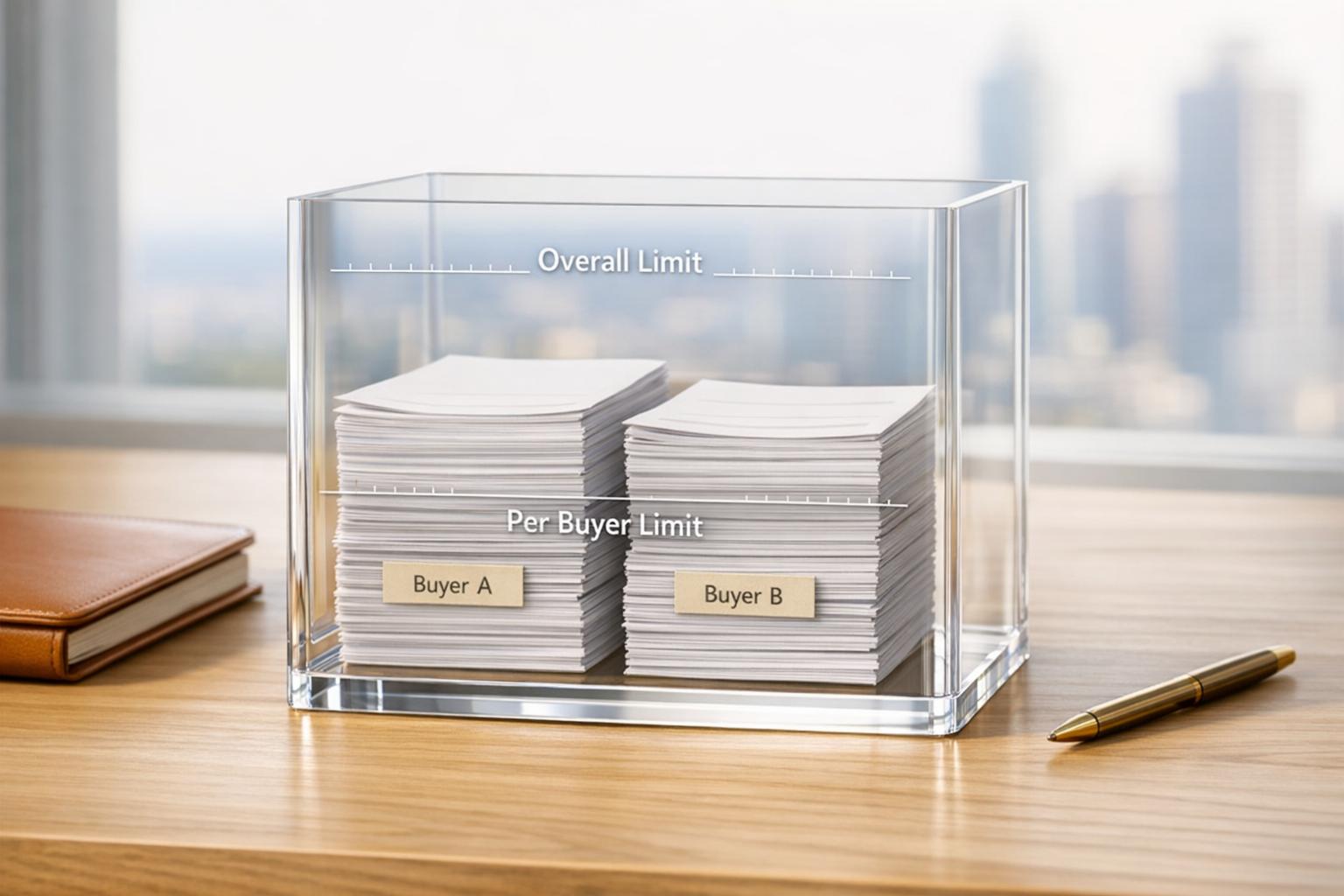

As business risks grow more complex, the need for personalized insurance solutions has surged. With U.S. business bankruptcies projected to rise by 23.5% in 2025 compared to 2024, companies are increasingly looking for comprehensive coverage to guard against payment delays and bad debt while making smarter credit decisions.

The trade credit insurance market reflects this demand. Valued at $11 billion in 2022, it is expected to grow to $26.6 billion by 2032, with a CAGR of 9.5% between 2023 and 2032. Accounts Receivable Insurance is a prime example of this tailored approach, offering policies designed to address specific risks in both domestic and global markets. These policies include detailed risk evaluations, efficient claims management, and access to a worldwide network of credit insurance carriers. Such features help businesses maintain steady cash flow and avoid financial disruptions.

Additionally, trade credit protection often allows businesses to borrow against a larger portion of their receivables, providing much-needed financial flexibility. The reliability of these solutions is evident – 97.73% of claim values were paid in full between 2007 and 2020, even during financial crises. By mitigating risks tied to less creditworthy clients, trade credit insurance supports businesses in safely exploring new, potentially challenging markets.

Managing Cross-Border Risks

Beyond domestic benefits, dynamic models are also improving how businesses manage risks in international markets. These models help mitigate challenges like political instability, currency fluctuations, and regulatory changes, protecting U.S. companies from defaults, insolvencies, and market volatility.

Predictive analytics plays a crucial role here. For example, businesses using these tools have improved their predictive accuracy by up to 50% compared to traditional methods, helping them better handle supply chain disruptions.

"At a time of economic difficulty, unlocking bank financing to the real economy is an important policy question governments must address. Recognising the protection that highly-capitalised and well-regulated insurers deliver to banks for precisely this purpose could be an easy win, benefiting businesses around the world in the long run."

- Richard Wulff, Executive Director, ICISA

"US regulators have a win-win opportunity here to further the Basel financial stability aims with a proven ecosystem – the insurance and bank partnership in the credit space. This ecosystem has the potential to create trade and help companies."

- Marilyn Blattner-Hoyle, Global Head of Trade Finance, Trade Credit & Working Capital Solutions, Swiss Re Corporate Solutions

For businesses looking to expand internationally, partnering with experienced brokers is key. These brokers can guide companies in choosing trade credit insurance options that align with their unique needs and help them navigate cross-border risks effectively.

Conclusion

Dynamic risk adjustment models are transforming how U.S. businesses approach trade credit insurance and risk management. The move from static to dynamic methods isn’t just about adopting new technology – it’s about staying competitive in a fast-evolving global market.

Key Takeaways for U.S. Businesses

Adopting dynamic risk adjustment models offers clear benefits. These systems speed up underwriting processes, simplify policy management, and encourage broader use of trade credit insurance.

The financial advantages are hard to ignore. With global losses from natural disasters hitting $357 billion in 2023 – and only 35% of those losses insured – businesses need stronger protection strategies. Dynamic models not only enhance coverage but also provide practical perks like better cash flow management.

Modernizing operations to embrace forward-looking risk strategies is crucial for U.S. businesses. This involves regularly updating risk profiles to keep up with technological advancements and emerging challenges. Partnering with experienced vendors can also provide the agility needed to navigate economic shifts, geopolitical risks, and climate-related threats.

"Dynamic risk modeling is a process that involves using mathematical and statistical tools to analyze and predict risks in a constantly changing environment. It allows businesses and organizations to adapt their risk management strategies by continuously updating models based on new data and evolving conditions."

- Vaia Editorial Team

These insights highlight the importance of adopting a proactive approach to risk management.

The Future of Risk Adjustment

Looking ahead, dynamic risk adjustment models are set to become even more integrated and advanced. Embedded insurance is projected to exceed $722 billion in global premiums by 2030, reflecting a growing demand for seamless, customer-focused risk management solutions.

Several trends are shaping this future. Advanced analytics and AI are becoming essential tools, while climate and geopolitical risks are driving businesses to invest in resilience strategies. Non-cancelable policies are also gaining traction, offering businesses the assurance of consistent coverage even if an insurer’s risk evaluation changes.

"In the AI space, technology and talent are two sides of the same coin. Insurers are building AI technology for the talent, by the talent."

- Sandee Suhrada, Principal at Deloitte Consulting LLP

Regulatory changes are also on the horizon. New global minimum tax rules could affect insurer profits in low-tax regions, while regulatory updates may open up more insurance markets.

Dynamic risk models are more than just tools for better risk assessment – they empower U.S. businesses to navigate uncertainties at home and abroad. For companies planning ahead, the message is clear: investing in dynamic risk adjustment models today lays the groundwork for managing the complexities of tomorrow’s global economy. Businesses that embrace these capabilities will be better positioned to thrive in an increasingly unpredictable world.

FAQs

How do dynamic risk adjustment models enhance accuracy compared to traditional models?

Dynamic risk adjustment models bring a new level of precision by constantly updating risk evaluations using real-time data and shifting conditions. Unlike static models that depend on fixed or historical data, these models adjust as circumstances evolve, offering insights that are both timely and accurate.

This flexibility is especially crucial in trade credit insurance. Factors like economic changes, payment trends, or political developments can shift unexpectedly. With dynamic models, businesses can strengthen their risk management, refine pricing strategies, and safeguard themselves more effectively against financial unpredictability.

How are AI and machine learning transforming dynamic risk adjustment models?

AI and machine learning are transforming how dynamic risk adjustment models work by introducing real-time data analysis and boosting predictive accuracy. These advanced tools enable models to adjust swiftly to evolving circumstances, offering businesses sharper and more responsive risk evaluations.

With the ability to process massive datasets, AI-driven models can uncover patterns, foresee potential risks, and suggest customized strategies. This not only improves decision-making but also helps reduce financial vulnerabilities – making these technologies especially useful in fields like trade credit insurance, where effective risk management is a top priority.

How do businesses use dynamic risk adjustment models to address climate and geopolitical risks?

Businesses today are turning to dynamic risk adjustment models to better navigate the challenges posed by climate change and geopolitical uncertainties. By incorporating real-time data into their risk assessments, these models empower companies to react swiftly to evolving situations, whether it’s fluctuations in energy markets or rising geopolitical tensions.

For example, cutting-edge models are now capable of evaluating the long-term financial risks associated with climate change, such as potential impacts on 30-year mortgage portfolios. At the same time, they offer short-term scenario analyses to forecast immediate financial effects. This forward-thinking approach enables businesses, including trade credit insurers, to reduce potential losses and refine their strategies to handle disruptions more effectively.